Those of us in the “government is a necessary evil, but still evil” demographic made many predictions about the result of Obamacare while it was being debated, after it passed, and even after the Supreme Court upheld it.

We did so based on past experience with sweeping “feel good” legislation, with our understanding of President Obama’s personal philosophy and agenda and the agenda of those in power in the Democrat party, on our understanding of basic economics and our grasp of human nature when faced with economic choices, just to name a few.

Let’s review a few of those predictions:

- Medicare would be cut to help fund it.

- Doctors would retire early to avoid it.

- Health insurance costs would not, as promised, drop. Instead, they would increase. Significantly.

- Many if not most people would not, in fact, get to keep their existing plans because of the increases in premium costs.

- New hiring would be detrimentally affected because businesses would not have any idea what new employees would cost, much less their existing ones.

- Some full-time employees would lose their full-time status so their employers could avoid having to pay for their insurance.

- Despite the law’s aims of “universal coverage,” many people would remain uninsured, perhaps as many as were uninsured before the law passed.

- Taxes on the middle class would, necessarily, rise to support the ballooning costs of the law – in opposition to Obama’s promise that he would not raise taxes on the middle class.

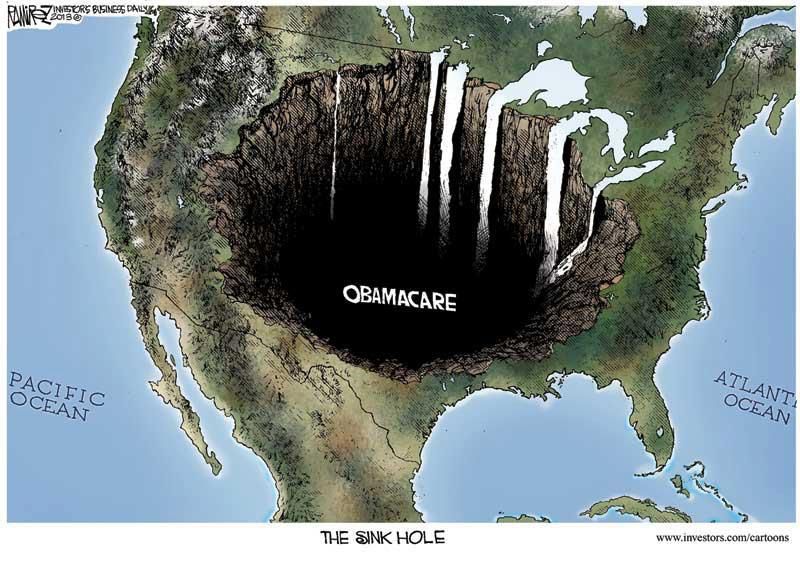

Boiled down into a single graphic:

So, here we are a quarter of the way into 2013, three years after Obama signed the Act and a year before its full implementation, and where are we?

So, here we are a quarter of the way into 2013, three years after Obama signed the Act and a year before its full implementation, and where are we?

National Center for Policy Analysis, March 12, 2013:

Though Republicans are usually responsible for calls to modify or end Medicare, the Obama administration has made the first move in cutting benefits. The administration’s cuts will impact the poor the most, says Joseph Antos, the Wilson H. Taylor Scholar in Health Care and Retirement Policy at the American Enterprise Institute.

- Low-income seniors will see an estimated 7 percent to 8 percent reduction in their Medicare Advantage benefits in 2014.

- As opposed to traditional Medicare, Medicare Advantage (MA) is provided by private providers and is attractive to lower-income individuals because it is less expensive.

- The reduction will occur because of the Affordable Care Act (“ObamaCare”), which is reducing Medicare benefits and raising taxes to pay for the expansion of Medicaid and subsidies in the health insurance exchanges.

- The cuts are larger than originally expected because the administration believes that Medicare spending will abruptly drop for no reason.

Private plans, averse to such a large spending cut, will likely leave markets or reduce their benefits as plans become less profitable.

More than 14 million Medicare beneficiaries will be affected by the cuts, which will disproportionately affect low-income individuals.

Forbes August 12, 2012:

A recent survey by the Doctor Patient Medical Association Foundation reveals that 83 percent of physicians surveyed are thinking of quitting because of Obamacare, and 90 percent feel that the U.S. health care system is now heading in the wrong direction.

This result is not a surprise; patients everywhere need to be concerned that Obamacare is putting an enormous new weight on the back of doctors who were already over-burdened.

This survey is not alone. Previous surveys by Athena, Sermo, Deloitte, the Doctors Company Survey, the Physicians Foundation, and IBD/TIPP have clearly shown that most doctors are unhappy with the direction of things, and a clear majority are opposed to the health care law. The Physicians Foundation survey in 2010 found that physicians view Obamacare “as a further erosion of the unfavorable conditions with which they must contend.”

Christian Science Monitor, March 27, 2013:

From the perspective of insurance companies, implementation of Obamacare will mean an average increase of 32 percent in the cost of medical claims per person by 2017, according to a study released Tuesday by the Society of Actuaries (SOA). But that figure will vary dramatically state by state, depending on how states handle their high-risk pools, which are then folded into the individual market under the reform. The cost of claims drives the price of health-care premiums.

“The projections in this study suggest that when the dust settles by 2017, we can expect mixed results on the reform bill’s goals of expanding coverage and reducing costs,” says Kristi Bohn, consulting health staff fellow at SOA, in the report.

In the SOA model, what are currently considered “low-cost states,” such as Ohio, Wisconsin, and Indiana, will see a large increase in the cost of medical claims – 80.9 percent for Ohio, 80 percent for Wisconsin, and 67.6 percent for Indiana. But the current “high-cost states” will see the average cost of medical claims go down. The biggest decrease, 13.9 percent, is projected for New York, followed by Massachusetts, with a 12.8 percent decrease.

Still too early to tell with that one, but I’m not holding my breath

Congressional Budget Office report, The Budget and Economic Outlook: Fiscal Years 2013 to 2023 (PDF, p. 61):

In 2022, by CBO and JCT’s estimate, 7 million fewer people will have employment-based health insurance as a result of the Affordable Care Act; in August, that figure was estimated to be about 4 million people. The revision is the net effect of several considerations, with the largest factor being the reduction in marginal tax rates, which reduces the tax benefits associated with health insurance provided by employers. The increased movement out of employment-based coverage also reflects revisions to CBO’s projections of income over time and higher projections of employment-based coverage in the absence of the Affordable Care Act.

Reductions in employment-based health insurance coverage boost federal tax revenues because they increase the proportion of compensation received by workers that is taxable.

—

CBO and JCT have raised their estimate of revenues that will come from penalties paid by employers, by $13 billion for the 2013–2022 period, because fewer businesses are now expected to offer insurance coverage than had been estimated in August.

Seven million, eh? Anybody want to place a bet?

The Staffing Stream (trade journal) Feb. 6, 2013:

Staffing firm with 50 or more full-time W-2 employees will be caught by the employer mandate and will have to provide coverage for its employees or face penalties.

If they do provide coverage, they will face increased costs and ugly administrative headaches. Take for example the look-back period, which was instituted to help companies (particularly staffing firms) that have employees working variable hours determine if those employees must be covered. They are allowed to use a look-back period ranging from three to 12 months. If the employee averages 130 hours during the look-back period, they must be offered coverage during a subsequent “stability period” that must be as long as the look-back period and can’t be shorter than six months. If it sounds complicated, that’s because it is. Firms who do not have a dedicated benefits person on staff may have to get one.

Your clients are facing the same challenges and are trying to find ways around the employer mandate. And they have to act now. Even though the employer mandate doesn’t go into effect until 2014, it will be based on a company’s 2013 payroll. So employers are already instituting hiring freezes, laying employees off, or cutting their hours below 30 hours per week. In fact, a Mercer study cited in a recent USAToday article stated that half of the companies surveyed that are not currently offering health insurance would make changes to their full-time headcount to avoid complying with the PPACA.

Credit Union Times, August 9, 2012:

Employers with large part-time and low-wage populations — especially retailers — are more likely to take measures in order to avoid triggering a costly requirement to provide health care coverage to employees that used to be ineligible.

According to a survey released Wednesday from consulting firm Mercer, 67% of retail/wholesale employers expect they’ll be making changes to their workforce structure so they can dodge a coverage eligibility requirement that’s part of the Patient Protection and Affordable Care Act.

Also, CNBC, Feb. 12, 2013:

For large retail and restaurant chains the big unknown in the year ahead is how much more they’ll pay for health coverage. Employers with 50 or more workers who put in 30 hours a week will be required to provide health care coverage or pay a fine, under the Affordable Care Act, also called the ACA or Obamacare. But the details haven’t been settled.

“We can’t really calculate what it’s going to be like,” said John Mackey, Co-Founder and Co-CEO of Whole Foods, an outspoken critic of the Obama health reform law.

His grocery chain already offers health care to workers at the 30-hour threshold. But he said the company may be forced to reconsider its full-time staffing levels, if the final employer mandate rules still being crafted by the Obama administration require companies to offer costly benefit options.

“Say we’re paying $3,200 a year for insurance for somebody, and the new regulations cost us $5,000 to insure somebody. If they work fewer hours, we just saved $5,000 per person,” because there is no mandate to provide coverage for part-time workers, he explained.

Also:

Batchbook has been offering health benefits from day one, even when the firm had no profits. “It was a big decision, but it was really important for us, that we build the company that we wanted,” O’Hara said.

Now, she and her HR manager are spending a lot of time trying to figure out how the Affordable Care Act, also known as Obamacare, will impact the firm’s benefit plan. This year, they chose a high deductible plan to keeps costs down. Their insurance broker said that plan may not comply with new limits on out-of-pockets costs for health plans beginning in 2014, so their rates are likely to rise. That could impact hiring plans.

“My policy is you don’t hire somebody unless you can afford them,” O’Hara explained. “The question is what we can afford to pay someone, when you don’t have a really good understanding of what that benefits package is going to cost.”

Many of the new mandated coverage details are still being finalized in Washington, including the so-called employer mandate.

“Still being finalized.” That would be this stack of regulations:

July 2012 Congressional Budget Office Report, Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision (PDF, p.13):

CBO and JCT now estimate that the ACA, in comparison with prior law before the enactment of the ACA, will reduce the number of nonelderly people without health insurance coverage by 14 million in 2014 and by 29 million or 30 million in the latter part of the coming decade, leaving 30 million nonelderly residents uninsured by the end of the period. Before the Supreme Court’s decision, the latter number had been 27 million.

Thirty million is certainly less than the 48.6 million reported by NPR on Sept. 12, 2012, but only about a third less, and we all know how accurate government projections tend to be.

On that last one? Increasing taxes on the middle class to pay for Obamacare? A cursory search of the web shows a lot of conflict on that one, much of it centered on that “penalty” vs. “tax” language that the Supreme Court decision rested on, but in addition to the bolded bit in that first CBO report excerpt above, I did find this little tidbit:

Chicago Sun Times Letter to the Editor, Jan. 1, 2013:

Here is a little-known fact about the Affordable Care Act: As of Jan. 1, the threshold for deducting medical expenses on your income tax return increased from 7.5 percent to 10 percent of adjusted gross income for nearly everyone. Seniors 65 and older get a reprieve for three years. It’s interesting that almost every article I’ve read on ObamaCare fails to mention this tax increase that will hit the “middle class” the hardest. Then again, Rep. Nancy Pelosi, who was then speaker of the House, did say, “We have to pass the bill so that you can find out what is in it.”

Of course, that only matters to those of us who itemize, but still…

Feel free to add your own links in the comments!

UPDATE: from the blog The Virginian:

It turns out that an upscale women’s fashion store that sells expensive women’s clothing and accessories has told its full time employee’s(sic) that they can’t work more than 21 hours per week and are hiring more people to take up the slack. As a result, they don’t have to provide health insurance to its part-timers.

But hey! “Hiring more people”! Unemployment’s coming down!

So, here we are a quarter of the way into 2013, three years after Obama signed the Act and a year before its full implementation, and where are we?

So, here we are a quarter of the way into 2013, three years after Obama signed the Act and a year before its full implementation, and where are we?