This is a harsh-your-mellow post of the Über-variety. You are forewarned.

Every generation has its Chicken-Littles, foretelling gloom, doom and disaster if Something Isn’t Done RIGHT NOW about some crisis du jour. Paul Ehrlich springs immediately to my mind, predicting from the depths of 1968 worldwide mass starvation by 1980 even if the world’s governments seized immediate dictatorial control over agriculture and human reproduction in his book The Population Bomb. Unapologetic more than forty years after his hyperbolic assertion that “The battle to feed all of humanity is over. In the 1970s hundreds of millions of people will starve to death in spite of any crash programs embarked upon now. At this late date nothing can prevent a substantial increase in the world death rate…”, Wikipedia reports that in 2009 Ehrlich and his co-author wife were proud of the book, stating:

The Ehrlichs stand by the basic ideas in the book, stating in 2009 that “perhaps the most serious flaw in The Bomb was that it was much too optimistic about the future” (my emphasis) and believe that it achieved their goals because “it alerted people to the importance of environmental issues and brought human numbers into the debate on the human future.”

Nothing if not brazen.

Oh, and well, wrong.

Then there are the Cassandras who can see what’s coming down the pike that the rest of the public can’t seem to. Their predictions aren’t as immediate, but can be every bit as doom-laden.

I’m not immune. In the seven years I’ve been writing here, one ongoing theme has been “Tough History Coming,” a phrase from a Peggy Noonan op-ed that caused quite a stir when it was published in 2005. Many pooh-poohed this (normally Pollyannish) Noonan observation:

I think there is an unspoken subtext in our national political culture right now. In fact I think it’s a subtext to our society. I think that a lot of people are carrying around in their heads, unarticulated and even in some cases unnoticed, a sense that the wheels are coming off the trolley and the trolley off the tracks. That in some deep and fundamental way things have broken down and can’t be fixed, or won’t be fixed any time soon. That our pollsters are preoccupied with “right track” and “wrong track” but missing the number of people who think the answer to “How are things going in America?” is “Off the tracks and hurtling forward, toward an unknown destination.”

One commenter stated, “(E)very generation, feels like the ‘wheels are coming off’ in some sense.” To which Billy Beck, responded: “Every now and then, they’re right about it.” In fact, I quoted Billy again just the other day on the same subject.

“Man-caused disasters” of epic proportion are hardly limited to assaults on Mother Gaia. We puny humans can screw ourselves up in other ways as well. What we appear to be best at is socio-political self-savagery, followed by the interpersonal type, and America is hardly exempt. In fact, we seem to be as exceptional at it as we’ve been at most everything we’ve tried. Now we’re trying economic self-savagery again, and this time we appear to be intent on doing it harder.

Let’s look at the evidence.

The United States federal budget has, since 1968, been in the black only five years according to this Congressional Budget Office report (PDF): 1969, and 1998-2001. Those last four years the budget was black only because the Social Security surplus was used to buy our debt. It’s always used to buy our debt (and the IOUs are put in AlGore’s “lockbox” and forgotten), but those five years the combination of overall revenue versus overall expenditure produced a bit of a surplus.

Over that 40-year period, the national debt climbed from $285.5 billion to $5.035 trillion, an increase of 1,763%. During that same period the expenditures of the federal government as a percentage of Gross Domestic Product hovered at about 20.6%, and tax revenue as a percentage of GDP hovered around 18.3%.

Think about that. Take the GDP as a value of 100 units. Our income was 18.3 units, our expenditures were 20.6 units. Our expenditures were 112.6% of our income on average. I don’t know about you, but I couldn’t run my personal finances for 40 years having to borrow the equivalent of 12.6% of my income each and every year, and never paying that debt down. Yes, I have a mortgage equivalent to a bit over 150% of my annual income, but I don’t pay it with my credit cards. My net debt has increased, but I at least understand that I have to pay it down, and so far I’ve been able to.

When Ross Perot ran for President in 1992, the national debt was in excess of $2.6 trillion, the deficit was in excess of $260 billion, Congress showed no intention of changing its spendthrift ways, and the executive showed no inclination to restrain them. Perot ran on a platform of fiscal responsibility and lost massively. Bill Clinton won the election, and say what you will about the man (and I have), deficits did decrease under his administration until there was actually more money coming in (if you include Social Security) than going out.

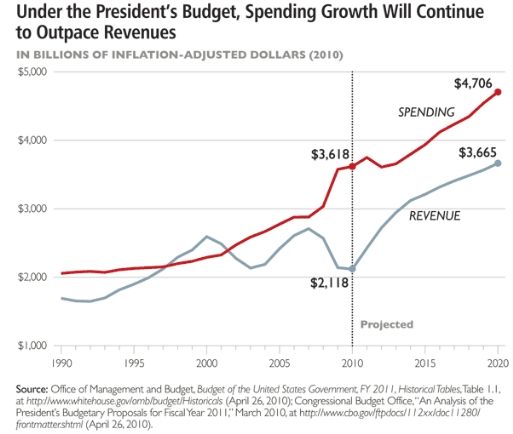

That changed abruptly. We were back to deficit spending where we’ve been ever since, and now we’re turbocharging it:

The data for this graph is from the Congressional Budget Office as well. The projected spending, if our Congressweasels don’t step up to the plate, is pretty much set. The projected revenue, on the other hand, is vaporware as far as I’m concerned. Does it look anything like 18% of projected GDP to you?

And will our Congressweasels step up to the plate? Why should they? They’ve been kicking the can down the road for decades already. Nobody wants to be the guy left without a chair when the music stops.

No, we keep hearing that we should “tax the rich.” Well, we do tax the rich. No, really. And it’s not enough to keep up with the spending.

And the Left keeps clamoring for more spending, and more taxes on “the rich.”

Iowahawk, in his inimitable way takes that concept to its logical conclusion.

I saw a bumper sticker the other day that made me want to drag the driver out of the car and beat him sensible with a Cluebat™. It said, “Hey, Conservatives: Medicare IS Socialized Medicine.”

Well, DUH. So is “Social Security.” What’s your point? They’re both failing, just like all “Socialized” programs do. Social Security?

“Social Security has been the most successful social program initiated by the federal government in the history of this country,” said Sen. Bernie Sanders, a Vermont

independentSocialist and the (Senate Social Security) caucus’s leader. “We are getting very tired of hearing Republicans saying Social Security is collapsing.”It’s not, and estimates are that its trust funds won’t be exhausted until 2037.

Trust fund? TRUST FUND?? The one that’s full of IOU’s from the National Treasury?

Fueling the new worry is a report this week from the nonpartisan Congressional Budget Office that suggests Social Security may be more of a drain on scarce resources – or in need of strengthening – than had been thought previously.

The CBO said that if interest were excluded, the system would run a deficit of $45 billion this year and a total of $547 billion from 2012 to 2021.

Medicare? Well, aside from the fact that Medicare doesn’t pay enough to make doctors want to accept it, it’s hemorrhaging money too. An estimated $100 billion a year through fraud alone. But there are bigger problems.

Medicare is already growing faster than Social Security, and it could become bigger and more expensive than Social Security in the next 25 years. It is also growing faster than the economy, and if that keeps up, Medicare could cause the national debt to swell up to more than two-thirds of the gross domestic product in just the next decade.

For years, experts have also warned that Medicare faces trillions of dollars in unfunded liabilities — meaning that it will have to pay trillions of dollars more than the amount of money that is coming in. In fact, last year, the Medicare trustees warned that the program was facing more than $36 trillion in unfunded obligations.

Even worse? Other payouts, in addition to Welfare and Social Security represent one-third of U.S. wages:

Even as the economy has recovered, social welfare benefits make up 35 percent of wages and salaries this year, up from 21 percent in 2000 and 10 percent in 1960, according to TrimTabs Investment Research using Bureau of Economic Analysis data.

And the public reaction?

Less than a quarter of Americans support making significant cuts to Social Security or Medicare to tackle the country’s mounting deficit, according to a new Wall Street Journal/NBC News poll, illustrating the challenge facing lawmakers who want voter buy-in to alter entitlement programs.

In the poll, Americans across all age groups and ideologies said by large margins that it was “unacceptable” to make significant cuts in entitlement programs in order to reduce the federal deficit. Even tea party supporters, by a nearly 2-to-1 margin, declared significant cuts to Social Security “unacceptable.”

Nick Gillespie of Reason says it: 3 Essential Facts About the Current Moment: We’re Out of Money, The Public Sector is Overpaid, & We Can’t Tax Our Way Out of This. Eric S. Raymond as well:

The political system I have been criticizing all my adult life is fast approaching the point of “no choices left”. And not just in the U.S., either; the same problems of political overcommitment and structural insolvency are playing out in advanced nations all over the planet.

Politics as we know it has had a structural problem for a long time; the self-destructive interest-group scramble that Mancur Olson identified in The Logic of Collective Action continually makes parasitic demands beyond the capacity of the underlying economy to supply, and the difference has to be papered over by massive government borrowing.This is all very well until, as Margaret Thatcher put it about socialism, “you run out of other peoples’ money.” The system is reaching that point now. Bond investors are figuring out that the debt load has become impossible and are increasingly refusing to either purchase new debt or roll over existing paper. The muni and state-bond market in the U.S. is near-moribund, and the threat of sovereign debt default is tearing the Euro zone apart. U.S Treasuries increasingly look like Wile E. Coyote running in midair; they’ll keep selling only as long as nobody actually looks down…

Insolvency is no longer a sporadic problem, it’s become pervasive at all levels of government everywhere. This is why the recent brouhaha in Wisconsin was so surreal. The public-employee unions weren’t just rearranging the deck chairs on a sinking Titanic, they were fighting to preserve their right to bore more holes in the hull.

References to the Titanic are getting to be common:

In the James Cameron [*spit*] movie “Titanic,” there is this great scene that illustrates a point about our current economic situation. The iceberg is struck. Because of the glancing blow, the more primitive metallurgy that resulted in brittle steel of the hull, a long gash was ripped across three of the main watertight compartment sections of the front of the ship. With the first three main sections rapidly filling with water, the engineer/ship designer, played by Victor Garber, lays out the side view plans of the ship to show the captain that there is no doubt that the ship is going down and there is absolutely no way to stop it. It may take an hour or so for the ship to disappear below the waves, but no amount of bilge pumping or anything else is going to stop the inevitable.

That’s what is happening with our economy.

There are a lot more.

The world is paying attention. After all, other governments are going broke, too, and fewer want to buy our debt.

I thought about filling this post with charts and graphs like the ones I started it with, but that’s not really necessary. If you read this blog regularly, you’re probably part of that tiny fraction of the population that’s paying attention. I’ve been working on this post for a while, collecting links and thinking. You see, I’m in kind of an odd situation. I’m an engineer, and the company I work for specializes in raping Gaia primary metals mining. Yes, we design the plants that process the ores ripped from Gaia’s womb the earth. Iron, copper, silver, gold, molybdenum, etc.

And we’re busy as hell.

So’s our competition.

We’re hiring, they’re hiring, the mining companies are spending money improving processes, expanding facilities, and building entire new mines all over the world.

So long as demand (and prices) stays high, we’ll remain so.

But I keep thinking that we’re sailing on the Titanic, rearranging the deck chairs while the public sector unions crew are boring holes in the hull and the aging population passengers are ceasing to bail out the bilges, but instead doing the exact opposite.

As I watch Japan dig itself out from under the – literal – fallout of a massive earthquake and tsunami, I observe as Victor Davis Hanson does, The Fragility of Complex Societies. Being an engineer, I do believe I understand the world in ways most other people never will. I understand, for one thing:

Reality is the murder of a beautiful theory by a gang of ugly facts.

Theory and reality are only theoretically related.

In theory there is no difference between theory and practice.

In practice there is.

And I understand that when someone high up in the financial machinery of the government states:

“If we continue down on the path on which the fiscal authorities put us, we will become insolvent, the question is when,” Dallas Federal Reserve Bank President Richard Fisher said in a question and answer session after delivering a speech at the University of Frankfurt. “The short-term negotiations are very important, I look at this as a tipping point.”

then The End is (most probably) Near™.

How near? Well, I’m 49 now. Let’s just say that I’m more and more convinced that Dale of Mostly Cajun was more right that he probably thought when he said:

Retire? I will probably get killed in the early battles of the coming revolution.

But it won’t be a revolution, I don’t think.

It’ll involve face colanders, possibly.

Richard Fisher said he was confident in the Americans’ ability to take the right decisions and that the country would avoid insolvency.

I’m not.

I started this essay with the working title of “Apparatchiks and Entropy,” inspired by my Quote of the Day for February 15, which stated in part:

The ability to get ahead in an organization is simply another talent, like the ability to play chess, paint pictures, do coronary bypass operations or pick pockets. There are some people who are extraordinarily good at manipulating organizations to serve their own ends. The Russians, who have suffered under such people for centuries, have a name for them — apparatchiks. It was an observer of apparatchiks who coined the maxim, “The scum rises to the top.”

The apparatchiks are, in part, that third of the economy made up of Federal payouts. They are, in part, the public sector union members boring holes in the hull of our Titanic economy. They are, in part, the people waiting to receive the benefits they’ve been told they were paying for all their working lives, whose proceeds even now they believe sit in “lock boxes”and “trust funds.” They are, in part, the people Peggy Noonan described:

I have a nagging sense, and think I have accurately observed, that many of these people have made a separate peace. That they’re living their lives and taking their pleasures and pursuing their agendas; that they’re going forward each day with the knowledge, which they hold more securely and with greater reason than nonelites, that the wheels are off the trolley and the trolley’s off the tracks, and with a conviction, a certainty, that there is nothing they can do about it.

I suspect that history, including great historical novelists of the future, will look back and see that many of our elites simply decided to enjoy their lives while they waited for the next chapter of trouble. And that they consciously, or unconsciously, took grim comfort in this thought: I got mine. Which is what the separate peace comes down to, “I got mine, you get yours.”

The apparatchiks have been manipulating organizations to serve their own ends, to “get theirs,” for so long now that the entropy is irreversible. The Titanic is sinking, and cannot be saved.

And I wonder what the future of my grandchildren is going to look like, because the Cassandric words of Donald Sensing still echo in my mind:

I predict that the Bush administration will be seen by freedom-wishing Americans a generation or two hence as the hinge on the cell door locking up our freedom. When my children are my age, they will not be free in any recognizably traditional American meaning of the word. I’d tell them to emigrate, but there’s nowhere left to go. I am left with nauseating near-conviction that I am a member of the last generation in the history of the world that is minimally truly free.

UPDATE: More cheery news with another Titanic reference.

UPDATE: Found this at Theo Spark: