Here’s a piece he wrote today at Quora I believe is worth your time:

__________________________________

Is the growing wealth gap in America the end of the American dream, or is America still the land of opportunity?

There is no growing wealth gap, generally speaking, in the United States. We had the same gap in 1776 and will have the same gap in 2276 (if not us, whoever our successor is). Switzerland has the same gap as do China and Malawi, Trinidad and Tobago. Even Yap has that gap.

All of this was shown six generations ago by an Italian economist stunned to find out as he plowed through mountains of data on income, on wealth, on land ownership and so on, that they graphed out the same in every single instance studied!!! Something bizarrely unexpected was going on.

Peter Thiel in his book Zero to One explains the mystery:

In 1906, economist Vilfredo Pareto discovered what became the “Pareto Principle” or the 80-20 rule, when he noticed that 20% of the people owned 80% of the land in Italy—a phenomenon that he found just as natural as the fact that 20% of the peapods in his garden produced 80% of the peas. [Note: Actually, Pareto studied many different polities and over different time frames and was astonished to see them all come out with the same result.] This extraordinarily stark pattern, when a small few radically outstrip all rivals, surrounds us everywhere in the natural and social world. The most destructive earthquakes are many times more powerful than all smaller earthquakes combined. The biggest cities dwarf all mere towns put together. And monopoly businesses capture more value than millions of undifferentiated competitors. Whatever Einstein did or didn’t say, the power law—so named because exponential equations describe severely unequal distributions—is the law of the universe. It defines our surroundings so completely that we usually don’t even see it.

Pay attention to what I am about to reveal. It is the conundrum of life.

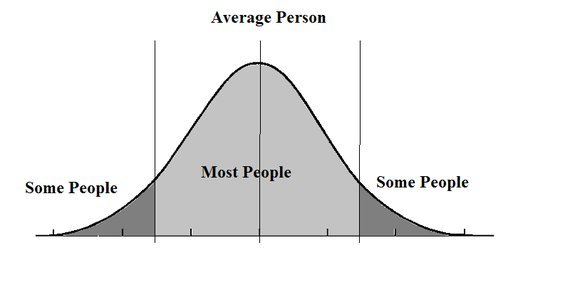

Inputs are Gaussian. They fit a bell curve:

Pick whatever attribute you want—looks, IQ, stick-to-itiveness, drive, number of friends—and it can be mapped on a curve like the one above.

Let’s say you pick the twenty traits that best correlate with getting wealthy, and create a new bell curve reflecting scores on all attributes. Then you perform a longitudinal study of who gets rich and who doesn’t. Outcomes of radically random processes do not fit to bell curves; they follow power laws, in the case of wealth, a Pareto distribution.

Something like one hundred different power laws have been identified in physics, biology, economics and other circumstances where the underlying relationships tend to be complex and stochastic (read: highly random). The highest-ranked person on your curve steps off a curb and gets hit by a bus. The lowest-ranked wins the lottery… stochastic.

This is the conundrum of life. Between what you have to work with and what you achieve falls a very large and random shadow. In the snapshot of life, it is always stark, but when you run the movie for a generation, you are no longer comparing workers just getting their start with those quite older and at their earning peak… much of the difference simply goes away.

But, interestingly, power laws produce quite uniform results. Power laws are of the form Y = MX^B

Where Y is a function (call it the result) which yields from a constant M times a variable X to some exponential value B.

B = 1 produces the linear scaling law and a straight line on the resulting graph. (To double a recipe, use twice as much of each ingredient. M=1, X=2, B=1)

B < 1 produces a non-linear result and diminishing returns. (If M is your training base and =1 and X is the volume of new training you put in and B = 0.5, then put in a 4 mile training run and you gain the ability to run 2 miles at a fast rate. Put in 16 miles and you gain the ability to run 4 miles at a fast rate.)

B > 1 produces non-linear results with increasing gain. Kinetic energy = 1/2mv^2, a second-order power law. Some power conversions are third-order and some heat radiations are fourth-order.

And B can be a variable in some power laws, such as compounding interest.

In a Pareto distribution, B is conventionally referred to as alpha and α = log₄5 ≈ 1.16. Alpha is variable, with 1.16 producing the common 80/20 division. It does vary within limits but not in a way amenable to policy control. In any case, it always tends back to 1.16. And if you are including negative numbers (wealth/debt for instance), a slightly different equation is used [see link].

Here is what happens if you give an equal distribution of money to a large number of people. In not very many transactions, it goes Gaussian (bell curve) and then stabilizes in a Pareto distribution. In other words, it is futile to try to equalize wealth, income, what have you, as long as people are free to transact it, which is pretty much the whole point of money. Take one minute to see how this works:

It doesn’t matter whether you are talking a free economy or socialist, older or modern, if money is being transacted, that is going to be the result.

However, it says nothing about who gets the money and how. Did you know, for instance, that our longtime lowest performing economic sector of almost twenty sectors has, over the last three generations, become our highest performing sector for income? Naturally, our lowest performing sector was the one that generates no revenues, namely, public service.

In the private sector (that is, all the others) non-revenue-producing workers are referred to as “staff,” and they are justified owing to their ability to increase the efficiency of line workers, who are revenue-generating. Accordingly, staff-worker pay tended to be about 80-percent of line workers, and so it always was for “public servants” when compared with workers in the for-profit world. Then President Kennedy issued Executive Order 10988 approving public-sector unions (something even Franklin Roosevelt had said could never be allowed for obvious conflict-of-interest reasons), and WHOA, NELLY!

Here three generations later, working for the government has become the surefire way to get wealthy. How? Government managers set staffing and pay levels with public-sector-union Reps with no taxpayers present. Those unions contribute heavily to the political candidates of one party all but exclusively. They have been over this time, the one segment beating inflation. Finance and Electronics have stayed even with inflation, while the rest of us have been losing ground for three generations—and this was the sad case prior to our present insane levels of Biden inflation. But public-sector salaries have doubled in ratio to private ones over this time!

And this also ignores government workers’ gold-plated defined-benefit pension plans after only thirty years. It also ignores all of the Chinese money that since Clinton reviewed the Chinese Troops in Tiananmen Square on the ninth anniversary of that massacre has been flooding our public sector with a large assist from Joe and Hunter Biden when it came to Hollywood and movie making. And it ignores that there is now so much corruption among elected officials that they rake in millions or even tens of millions over their careers… and they are not even tending to our best interests.

When it’s billionaires at the top who made their money productively, we’re all much better off as their share of the wealth is only ever a small fraction of the social wealth their enterprise created. Personal wealth created by corruption, quite oppositely, is more often a sign that our best interests are being at best ignored if not traded away.

So, the answer is that the wealth gap will always be there and, by itself, indicates nothing about opportunity. In fact, in a productive economy, opportunity grows for all even as the rich get richer! When it becomes such a large-scale corrupt economy, you are almost certainly being savagely robbed of opportunity… something to think about in the coming months leading up to the election. – Charles Tips

______________________________________

Worth your time? Leave a comment.

Definitely geeky and math-nerdy, but very interesting.

Since I spent a few years as a QC supervisor/manager while finishing school at night, so Pareto is as embedded in my brain as it gets. So are the statistical distributions and things. Interesting see them tied together as different ways of viewing the same things.

And Oh, BTW, you have 12 paragraphs in there twice, starting with “Pick whatever attribute you want—looks, IQ” Copy and paste oopsie. Confused me the first time.

Thanks for the heads-up. Fixed.

Ya know, if you get out of high school without a deep understanding of the Bell curve, the Pareto distribution, the bathtub curve and dozens of other essential topics without which cannot effectively either understand or engage the world, your government education, funded by the public under the theory that an educated populace is crucial for the vibrant success of democracy, has abjectly failed you.

So, let us observe, once again, that government schooling has failed.

Whether this is cockup or conspiracy, accident or design no longer matters.

Let us also observe that after this many decades of cumulative failure, with one undermined and diminished generation teaching the next, that the thing has reached critical mass, and is now a self sustaining negative outcome synergistic reaction with nary a control rod in sight.

If this kind of information survives the coming turning point, whoever is left to rebuild will have iron-clad data on the systems that need protecting, and how to do so. Much like the terrorist on a U.S. plane scenario, what the anti-civilization forces are doing will no longer work.